Critical Necessity: India’s recently-concluded defence deals with Germany, the United States and France have few unmistakable common essences in each of them. They are all multibillion-dollar projects, each of them addresses India’s critical technology needs and each of them has Indian industries partnering with global arms manufacturers. India’s neighbourhood security environment continues to appear challenging, making cutting-edge defence requirements a critical necessity. As Indian security forces expectedly fine-tune their operational readiness, they are also looking for smart acquisitions from both international and domestic suppliers. India’s twin approach of objectively charting out its security needs and making the Indian private sectors compete has proven to be enormously valuable.

India remained the largest importer of defence equipment since 1993, the domestic production stood at a meagre 45 per cent of its overall requirement. However, the subtle moves in the last decade have encouraged foreign suppliers to engage with Indian partners, undertake technology transfer and majorly do production in India. This approach was expected to complement the ‘Make in India’ initiative laid out in September 2014. These initiatives led to a flurry of activities in 27 different sectors including strategically important manufacturing and services sectors. But it’s safe to say, that it’s the defence sector which is witnessing a marked improvement.

The Turnaround

India opened its defence sector in 2001 offering licenses for 100 per cent private productions of defence equipment. Some policy changes in 2016 like Indigenously Designed, Developed and Manufactured (IDDM) products were accorded top priority for procurements, similarly ‘Buy Indian’ and ‘Buy & Make Indian’ categories got higher priority over ‘Buy Global’ and ‘Buy & Make Global’. The government brought in a strategic partnership model for long-term engagement with Indian private industries. This model encouraged them for creating joint ventures with global arms manufacturers and produce locally in India. To further stimulate private partnership 90 per cent of government funding in ‘Make’ categories was introduced for Indian MSMEs.

The policy refinements allowed new incumbents to showcase their products to the armed forces directly and also allow services to offer their testing facilities to domestic manufacturers. This was a key parameter as any new product needs to undergo extensive field testing before it can be certified for use. The challenge in front of the private sector was also unique, while they have to arrange for capital to first make the production line operational, they also had a very limited customer base. Some of the companies like the Kalyani Strategic Systems (KSS) who were looking to manufacture medium calibre Artillery Guns for the Indian Army were undertaking major investments without actually having an assured customer! While the competition from foreign suppliers was intense with battle-proven and readily available products.

Fast forward to 2023, the KSS has bagged $155.5 million worth of orders from Saudi Arabia for supplying 155/52 mm calibre Bharat 52 Guns. The Philippines chose the BrahMos missile and India agreed to export Pinaka MBRLs to Armenia. India has issued manufacturing licences to 333 domestic companies to date for the production of 539 items. The 12th Def-Expo held last year in Gujrat witnessed whooping participation by 1340 Indian companies! There are a total of 45 Indian companies which have already tied commercial partnerships with foreign players. India has prepared lists of 3738 defence items, of which 2786 items have already been indigenised. India has successfully reduced its defence imports by 11 per cent, as per data shared by the global arms trade monitoring agency SIPRI. These are not just the figures but represent a strong indicator of growth in the domestic defence sector. It’s unmissable and a very loud statement by India which is rapidly closing the gap between its security requirements and domestic manufacturing.

Self-Reliance

India’s progress towards self-reliance in the defence sector is hastened by four critical factors; the need to address challenging security dynamics, assured supply, economisation and sustainability. Each of these four factors further splits out into multiple nuanced approaches such as prioritising direct acquisitions where needed, entering into government-to-government deals to fasten up the process, integrating Indian subsidiaries with foreign suppliers, substantive domestic production and transfer of technology clauses in contracts. This multifarious approach has enabled the country to now get a firm standing on the ground as far defence manufacturing is concerned and to an extent in design and development aspects as well. This has also opened up the possibility to explore new markets by both PSUs and private sectors affording them to further improve and economise production lines.

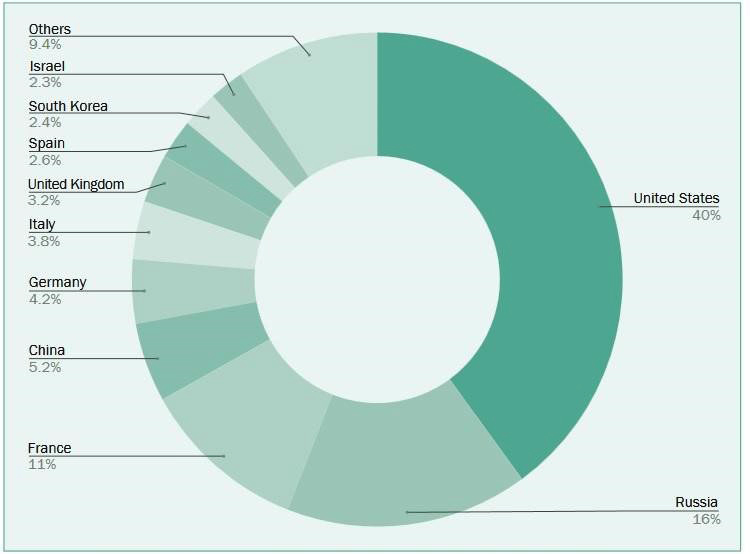

In 2021, the global defence market was estimated to be worth $ 474 billion and is expected to almost double within a decade. As per the Arms Control Association, a US-based agency supporting effective arms control policies, the US remain a global leader in arms exports with a 40 per cent market share, while other major players like Russia held 16 per cent and France 11 per cent of the global arms market. India, a very young entrant, has witnessed a tenfold rise in defence exports in just six years. Indian defence exports jumped to almost $ 1 billion in the fiscal year 2022-23. It’s a 24 per cent increase from the previous year’s export figures. These are very encouraging signs and in synch with India’s ambitious aim of achieving a defence exports target of $5 billion by 2025.

The Future Trajectory

The future trajectory appears to indicate significant activities in the Indian defence sector with the government’s continued push for stabilising a complete manufacturing ecosystem and end-to-end solutions. Indian private defence companies are now venturing into bold and unchartered territories such as Agnikul Cosmos in Space, Tata Elxsi & Wipro in AI, Invento Robotics & FANUC India in Robotics, and IROV Technologies in under-sea drones to name a few. Whereas GMR, L&T and Reliance have plans ready to venture into the strategic nuclear sector. Even defence PSUs are working to optimise and unlock their massive potential.

The progress thus far has been very exciting and the ‘successes’ met are somewhat unexpected. The upside to this journey has been gains in confidence and momentum to the entire defence R&D and manufacturing in the country. A glimpse in history suggests that all major defence behemoths like Lockheed Martin, Boeing, BAE Systems and General Dynamics all started with modest beginnings but what made them what they are today is continuous innovativeness, persistence with quality, competitiveness and government support.

Indian defence industries would now need to take the next leap upward. While competition is healthy collaboration proves progressive. India’s defence sector players private or public need to look for collaboration among themselves. This would allow leveraging of major assembly lines, testing facilities, and human capital of PSUs by private R&D, investments and innovativeness. This will prove to be a win-win situation for both and make better business sense if the Indian defence sector has to grow into one of the major global players. The government would be keenly interested and an active partner in the process, as it looks to transform India from a net importer to a net exporter in defence production.

-The writer has varied experience in security paradigm and is a keen follower of international geopolitics. His work has been routinely featured in national publications and newspapers. His articles can be viewed on the popular blog site newsanalytics.co.in on geo-strategic affairs.