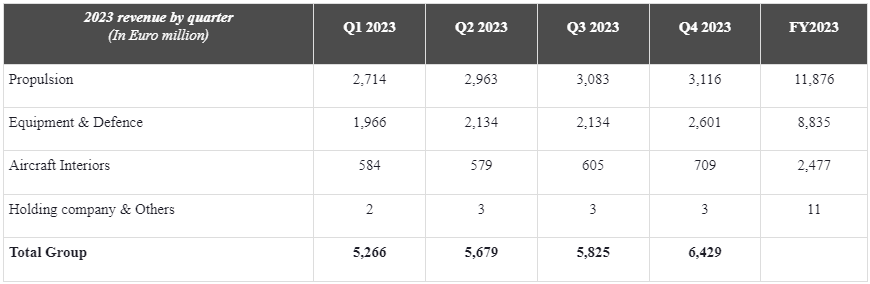

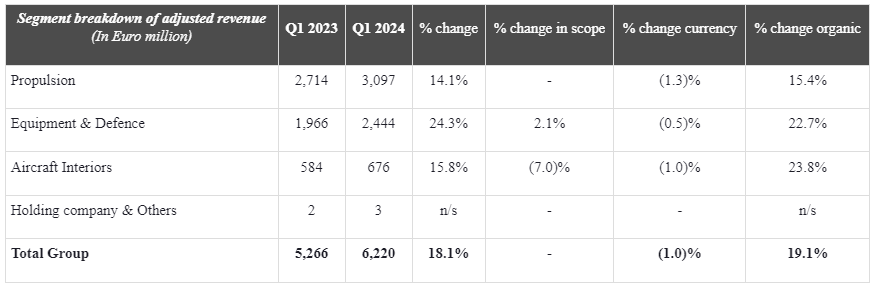

Paris: World’s second largest aircraft equipment manufacturer Safran of France, had a double digit growth in all business with first quarter of 2024 recording a revenue of EUR 6,220 million which was up 18.1% with consolidated data showing a revenue of EUR6,280 million.

“Safran had another strong start of the year, with double-digit revenue growth in all businesses and civil aftermarket benefitting from the continued good dynamics in air traffic and an increasing contribution of CFM flight hour contracts. LEAP engines delivery volumes reflect the soft start of aircraft production. We remain focused on meeting our customer commitments and mitigating short term challenges and are confident to deliver our financial performance for the year,” said CEO Olivier Andries.

At €6,220 million, Q1 2024 revenue increased by 18.1% compared to Q1 2023. The changes in scope during the quarter1 balance each other out, resulting in no impact at Group level.

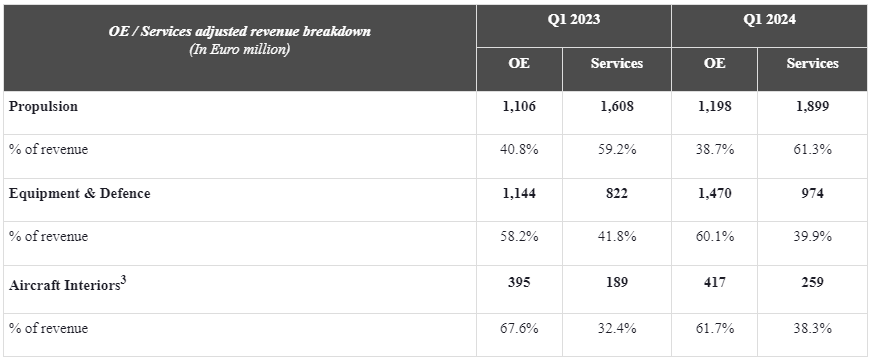

The Propulsion revenue increased by 15.4% thanks to strong civil aftermarket activity. This strong growth came in particular from LTSA2 for CFM56 and LEAP engines, a trend that should subside from the second quarter onward. The revenue from spare parts for CFM56 and high-thrust engines was in line with expectations. This quarter’s performance has no impact on full-year expectations.

Military activities were down compared to Q1 2023 with notably fewer M88 deliveries related to contract phasing.

Helicopter turbine activities grew slightly thanks to OE and to a lesser extent to services, both still penalised by supply chain difficulties.

Equipment and Defence posted significant growth (+22.7%) coming from all activities.OE sales registered a 26.7% increase year over year supported by both narrow body and wide body programs and a low comparison basis in Q1 2023.

Volumes were up for landing gears (A320neo, A350, 787), power and wiring (A320neo, 787), avionics (FADEC for LEAP) as well as nacelles (A330neo). Electrical systems deliveries were impacted by lower 737MAX shipsets.

The revenue in Defence were up significantly, led by guidance systems, JIM multifunction infrared binoculars and optronics activities.Services sales, driven by a continuing positive trend in air traffic, grew in all businesses, in particular landing gears and nacelles.

Aircraft Interiors revenue increased by 23.8% but still remains 10% below 2019 level. Growth was mainly driven by services from all activities, notably in Seats.

In 2024, Safran launched a new share buyback tranche to complete the hedging of the potential dilution related to the 2028 convertible bonds and for long term incentive plans. As such, Safran bought back approximately €141 million worth of its own shares. The execution of this tranche was interrupted as the maximum repurchase price (€175) authorized by the general meeting of May 25, 2023 has been exceeded. If market conditions permit and if the resolution proposing to shareholders to set the maximum repurchase price at €300 per share is approved at the general meeting of May 23, 2024, Safran plans to complete this tranche in 2024.

As announced in July 2023, Safran will then launch a €1 billion share buyback for cancellation; this buyback is expected to be carried out during 2024 and 2025.

As of March 31, 2024, Safran held 14 million of treasury shares.

The company’s revenue was around €27.4 billion while recurring operating income was close to €4.0 billion and free cash flow was around €3.0 billion, subject to payment schedule of some advance payments.

This outlook is based notably, but not exclusively, on the assumptions that the LEAP engine deliveries is up by 10%-15% (previously 20-25%) and civil aftermarket revenue (in USD): up by around 20%. The main risk factor remains the supply chain production capabilities.

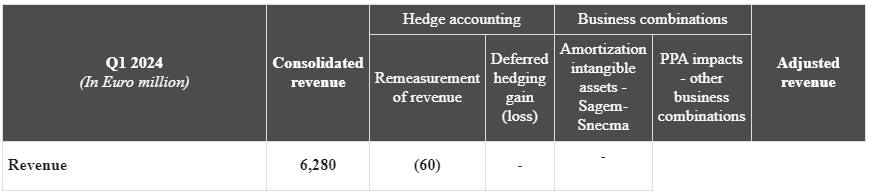

To reflect the Group’s actual economic performance and enable it to be monitored and benchmarked against competitors, Safran prepares an adjusted income statement in addition to its consolidated financial statements.

Safran’s consolidated revenue has been adjusted for the impact of various factors which include the mark-to-market of foreign currency derivatives, in order to better reflect the economic substance of the Group’s overall foreign currency risk hedging strategy:

- revenue net of purchases denominated in foreign currencies is measured using the effective hedged rate, i.e., including the costs of the hedging strategy,

- all mark-to-market changes on instruments hedging future cash flows are neutralised.

The resulting changes in deferred tax have also been adjusted.

First-quarter 2023 reconciliation between consolidated revenue and adjusted revenue:

Key figures

1. Segment breakdown

3 Retrofit is included in OE