Over the past year, the strategic embrace between the United States and India has become unmistakably more complex. Cooperation in defence, technology, and energy has been advancing, but so too have tensions — particularly on trade, visa policy, sanctions, and regional alignment. Policies such as sweeping US tariffs on Indian imports, the revocation of the waiver on Chabahar port sanctions, steep H-1B visa fee hikes, and increasing US engagement with Pakistan have raised questions about the durability and direction of the bilateral relationship.

India now finds itself navigating a strategic landscape where opportunities abound — but so do trade-offs. The key questions are: Why is the US doing this now? What are the implications for India’s strategic autonomy, economic interests, and foreign policy? And how can India respond so as to preserve and enhance its long-term national interest?

This article examines these dynamics in detail and offers a framework for how India might respond.

What Has Changed — Key Flashpoints

Tariffs and Trade Levers: One of the most immediate sources of friction is US tariff policy. India has been hit with “reciprocal tariffs” and penalty tariffs tied to its ongoing purchases of Russian oil. In some cases, US duties on Indian exports have reached 50 per cent. These trade measures are part of a broader effort by Washington to use trade policy as a lever of foreign policy, especially in its strategy to isolate Russia economically. These tariffs are not just economic punitive measures; they signal a broader expectation: that India align more closely with US positions on energy sanctions, supply-chains, and global norms. The tariff measures affect export-oriented sectors in India — textiles, gems and jewellery, seafood, dairy products, farm sector etc. — and also put pressure on India to modify its broader external policy.

H-1B Visa Fee Hike and Immigration Policy Shifts: Another major recent development is the US decision to impose a $100,000 fee on new H-1B visa applications, effective from a certain cutoff (after September 21, 2025). Existing visa holders or those whose petitions had been filed before that threshold are not immediately affected. But for new applicants which includes many Indian nationals in the tech and services sector, this is a dramatic increase in cost. This policy forms part of a broader US move to restrict immigration related to skilled foreign workers, to respond to domestic political pressures over job competition, outsourcing, and immigration. It also serves as a tool to force India to localise more of the value — by increasing the cost of sending Indian workers abroad.

Chabahar Port and Sanctions Waiver Revocation: For many years, India has invested in Chabahar port (particularly the Shahid-Beheshti terminal) in Iran as a strategic asset: to provide connectivity into Afghanistan and Central Asia, bypassing Pakistan, and to facilitate regional trade corridors (including parts of the International North-South Transport Corridor). Because of that strategic value, India was granted a US waiver under certain Iran sanctions so that its operations in Chabahar would not come under US penalties. In 2025, the US has announced that it will revoke this waiver effective around September 29, 2025, meaning that operations, funding, or investment connected to Chabahar could face sanctions under the Iran Freedom and Counter-Proliferation Act (IFCA). This move disrupts India’s connectivity and energy ambitions in West and Central Asia. It also raises questions about India’s ability to pursue independent foreign and regional policy when expectations from Washington on sanctions compliance become more rigid.

US Engagement with Pakistan: While India and the US have increasingly aligned in many strategic ways — Indo-Pacific Strategy, maritime security, critical technology cooperation — US foreign policy continues to maintain ties with Pakistan, particularly in counterterrorism and regional stability contexts. Recent US statements and diplomatic gestures suggest that the US is hedging: not disengaging from Pakistan, but trying to ensure that Islamabad doesn’t fully drift into adversarial blocs. This is a long-standing US approach of balancing its South Asia policy, but in the current environment of pressure on India over trade and sanctions, such outreach to Pakistan can be perceived and used as leverage in the larger US strategy.

The trade measures are not merely economic penalties; they reflect Washington’s broader expectation that India align more closely with US positions on sanctions, supply chains, and global norms. They underscore how trade and foreign policy have become increasingly intertwined in shaping the contours of Indo–US relations

Why is this Happening Now?

There are several interconnected drivers pushing the US towards these policies at this time. Understanding them helps explain whether these are temporary irritants or indicators of a deeper shift.

US Domestic Politics and Protectionist Pressures: Heated concern over job losses or wage stagnation in key US sectors has driven administrations of both parties to adopt tougher trade and immigration policies. The H-1B visa crackdown responds to American political constituencies who argue that foreign skilled workers are undercutting US labour. Congress and interest groups exert pressure on the Executive to tighten trade norms, impose reciprocal tariffs, and enforce sanctions strictly, particularly in light of the war in Ukraine, competition with China, and domestic economic anxiety.

Strategic Foreign Policy Objectives: US strategy toward Russia and Iran is central. The US wants to reduce the ability of Russia and Iran to finance their operations, particularly in the aftermath of the Ukraine war and rising tensions in the Middle East. India’s continued energy trade or connectivity with these countries complicates US sanctions strategy. The US sees India as a crucial strategic partner in balancing China’s influence in the Indo-Pacific. But strategic partnership doesn’t mean complete alignment. Washington expects India to take clearer positions or actions that support US goals — and uses economic tools to motivate that alignment.

Global Supply Chain Reordering and Tech Competition: The US is placing great emphasis on securing supply chains for semiconductors, critical minerals, and technology infrastructure. This includes using export controls, investment restrictions, and incentives for “trusted partners.” Immigration policy (like H-1B) becomes part of this calculus: talent is a strategic resource. By making immigration costlier or more restricted, the US aims to domesticate more parts of the tech value chain and reduce dependence on imported labour.

The Russia-Ukraine War and US Energy/Policy Coercion: Sanctions on Russia are now central to US foreign policy. US sees trade with Russia (especially energy) as a means by which adversaries can evade sanctions. India’s purchases of Russian oil are now a leverage point used by Washington to push for policy changes. Similarly, the Iran sanctions posture is tightened, especially under “maximum pressure” policies. The Chabahar waiver revocation falls in line with that.

Implications and Risks for India

These developments pose several immediate and long-term risks to India’s strategic and economic interests. At the same time, they open up new opportunities if India adapts smartly.

Risks

Economic stress on export sectors & services. Tariff hikes can severely damage competitiveness in labour-intensive, export-oriented sectors. Service-exporting firms from India (especially in tech) are vulnerable if H-1B restrictions limit their ability to send talent to the US or participate in US customer-facing projects.

Strategic and policy constraints. The revocation of the Chabahar waiver constrains India’s ability to pursue independent foreign policy, especially in West and Central Asia. It can force India into more binary positions in sanction regimes.

The revocation of the Chabahar waiver constrains India’s strategic autonomy in West and Central Asia, compelling New Delhi to rethink its regional outreach. It disrupts India’s carefully cultivated connectivity strategy and challenges its ability to pursue an independent foreign policy amidst tightening US sanctions

Erosion of Trust and Diplomatic Goodwill: Abrupt policy shifts (tariffs, visa fee hikes, sanctions retractions) can be experienced in Delhi as slights or lack of respect for Indian priorities. Over time, this could reduce India’s willingness to align with US policy on critical global issues when Washington demands it.

Industrial dependency and tech limbo. If access to talent, tech, and investment gets conditioned heavily on political alignment, India may find its industries constrained in supplier choice, IP access, or technological autonomy.

Regional balance disruption. US outreach to Pakistan coupled with pressure on India could embolden Islamabad’s strategic posture. It also complicates India’s regional connectivity and counterterrorism efforts.

Opportunities

Leverage for stronger trade deals. The current frictions give India stronger bargaining power — Washington is keen to show that the alliance is not frayed. India can negotiate more favourable trade terms, clearer market access, dispute-resolution mechanisms.

Push for genuine ToT and co-production in defence & tech. With US needing India as a strategic partner, New Delhi might extract more substantial technology transfer, joint R&D, and manufacturing roles.

Accelerate domestic talent and innovation ecosystems. The visa and talent restrictions may incentivise India to invest more heavily in its own education, tech R&D, startup ecosystem and retain domestic talent.

Diversify Partnerships: The pressures from the US may encourage India to double down on its ties with other countries — EU, Japan, Middle East, Russia — to avoid overdependence, and to build counterweights in both trade and strategy.

What Should India Do? A Strategic Response

To navigate this fraught terrain, India needs a coherent strategy that both mitigates risks and seizes opportunities. Below are strategic recommendations.

Diplomacy and Negotiation: Be Proactive, Not Reactive

High-level dialogues: Use bilateral summits, MEA-State Department talks, trade delegations to keep channels open. The meeting between Foreign Minister Jaishankar and US Secretary of State Marco Rubio in New York (UNGA) is one example of signalling continuity despite conflict.

US outreach to Pakistan, coupled with economic pressure on India, risks unsettling the delicate regional balance and emboldening Islamabad’s strategic posture. This dual-track approach may erode trust in Washington’s commitment to India’s regional priorities.

Linkage diplomacy: When discussing trade and visa issues, India should link them to cooperation areas it cares about (defence, critical minerals, climate, Indo-Pacific security). This gives Delhi more bargaining levers.

Multilateral engagement: Bring in third parties and multilateral institutions for issues where US policy is unilateral (e.g., Chabahar, sanctions). Engaging with EU, Japan or UN frameworks can reduce isolation and increase legitimacy.

Trade Strategy: Targeted Adjustments and Diversification

Assess tariff exposure: Identify which export sectors to the US are most vulnerable, and prioritise protective or compensatory support (for example, subsidies, alternate market access, or product upgrading).

Selective tariff reduction and concessions: Where possible, India might be willing to adjust or reduce tariffs in US-sensitive goods (e.g. autos, liquor, medical devices) if this is traded for US concessions on visa, technology access or sanctions waivers.

Strengthen regional trade ties: Expand exports to alternative markets (ASEAN, EU, Middle East, Africa) so dependence on the US is moderated. Negotiating preferential trade or FTAs with such partners will help.

Tech, Talent and Immigration Policy

Talent home-shoring / domestic capacity building. Given rising costs / barriers for sending skilled talent abroad, Indian firms should increasingly invest in domestic skills, R&D, and encourage reverse brain drain. Emphasis on improving STEM education, labs, AI, quantum etc.

Advocate for rational visa regimes: Through diplomacy, legal channels, and multilateral forums, India should push for visa regimes that are fair, transparent, predictable. The $100,000 fee hike for H-1B may be legally challenged or negotiated down.

Build alternative institutions for talent exchange: Bilateral fellowships, joint research centres and centres of excellence can mitigate the impact of stricter US immigration/visa norms.

Chabahar and Connectivity Policy

Lobby for carve-outs or waivers: Engage US Congress and relevant departments to argue that Chabahar is essential for humanitarian and regional stability purposes (e.g., Afghan transit, Central Asia trade), not enabling Iran’s sanctioned operations. Indian arguments should emphasise non-alignment and development focus.

Multilateralise Chabahar: Bring in partners (EU, Japan, UN) to share investment, operation, or oversight of Chabahar. This raises its profile not just as India’s project but a shared regional connectivity node.

India must pursue a coherent strategy that mitigates risks, leverages emerging opportunities, and ensures that strategic autonomy remains the cornerstone of its foreign policy. A proactive diplomatic posture and diversified partnerships will be essential to sustain long-term equilibrium in its relations with the United States

Build parallel corridors: To reduce vulnerability, build multiple connectivity routes (e.g. via the Persian Gulf, Central Asia, even through Russia etc.). Invest in infrastructure, transport, logistics to reduce single-point dependencies.

Defence and Strategic Cooperation

Insist on technology transfer & co-production: Use procurement deals as leverage. When procuring US systems, ensure clauses of IP ownership, local manufacturing, skill transfer are not token but enforceable. Delivery timelines matter.

Deepen interoperability & foundational agreements: Agreements like BECA, LEMOA/LEMOA, COMCASA etc already help. Continue building trust through joint exercises, shared standards, dual use logistics.

Strategic autonomy as policy: Be clear that India will not be forced into binary blocs. This preserves credibility at home and flexibility abroad. Articulate India’s policy convictions rather than reacting passively.

Domestic Policy Adjustments

Boost competitiveness. Improve ease of doing business, regulatory clarity, infrastructure (port, transport, power). This helps Indian firms adjust to higher costs imposed by tariffs or visa restrictions.

Support export and services sectors. Provide targeted credit, insurance, risk mitigation for sectors exposed to US tariffs; foster greater value addition so that India moves up the global value chain.

R&D, innovation, education. Scale up tech incubators, AI labs, semiconductor missions. Encourage domestic research and align with global norms of data governance, cyber security to make India an attractive “trusted partner.”

Takeaways

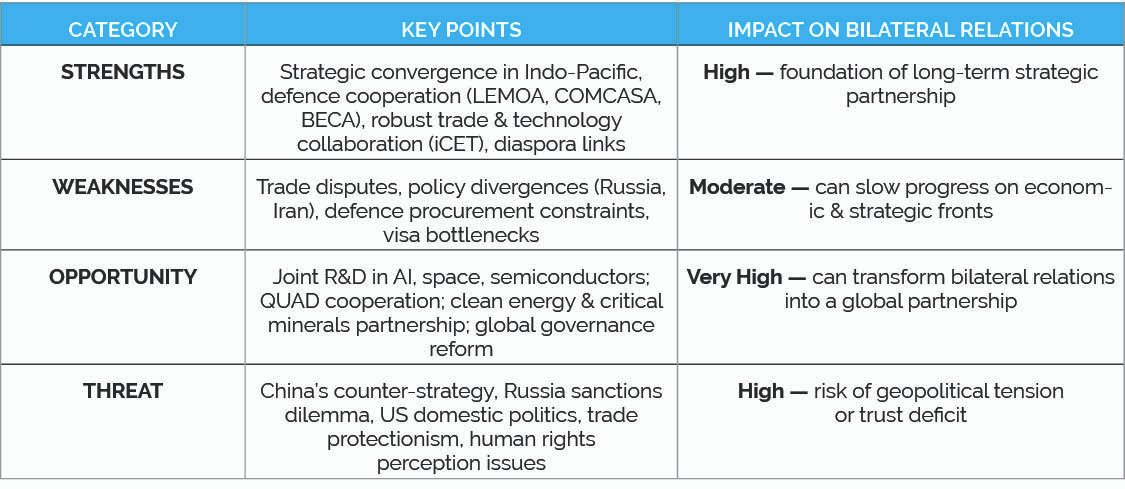

It is appropriate to conclude with a SWOT Analysis of Indo-US relations and the opportunities identified could be explored.

-The author retired as Major General, Army Ordnance Corps, Central Command, after 37 years of service. A management doctorate and expert on defence modernisation, he is the author of four books, including the Amazon bestseller “Breaking the Chinese Myth,” and a frequent media commentator. He is affiliated with several leading defence and strategic studies institutions in New Delhi. The views expressed are of the writer and do not necessarily reflect the views of Raksha Anirveda