Introduction: The View from Both Sides of the Ocean: When I first stepped into a technology boardroom in Bengaluru in the early 1990s, India’s tech ambitions were still embryonic. The global narrative then painted India as a back-office for the world—an efficient code factory but not a hub for original invention.

Years later, working in Silicon Valley, I found myself defending Indian talent not for their coding skills—already proven—but for their capability to conceptualise, design, and lead global innovation.

Fast forward to 2025: India is the fastest-growing major economy, the third-largest startup ecosystem, and home to a booming deep-tech sector. But the question remains—are we truly on the brink of becoming a technology powerhouse, or is this simply a well-marketed aspiration?

The Data Behind the Narrative

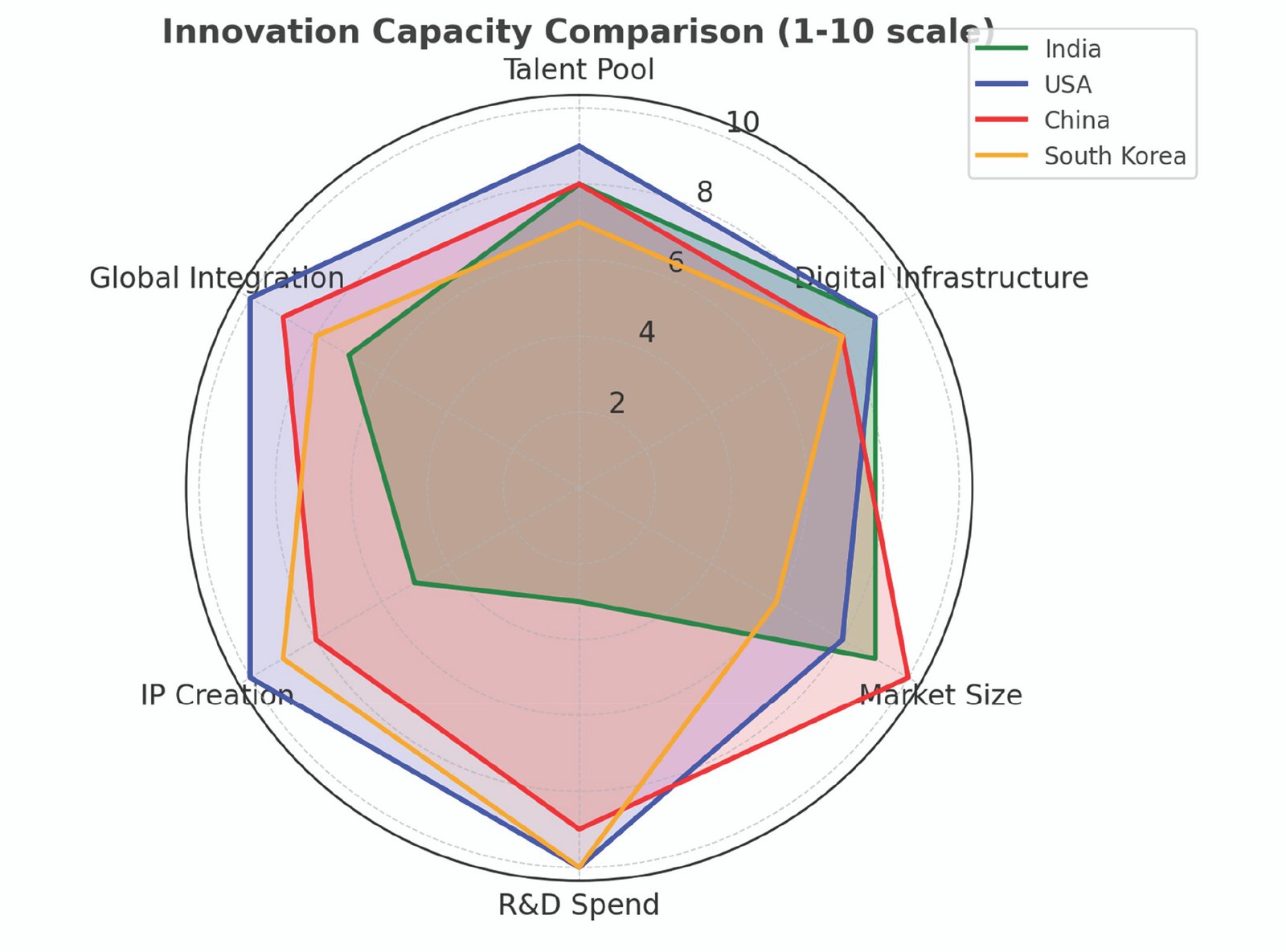

Graphic: Innovation Capacity Comparison (2025)

Strengths: Talent, digital infrastructure, market size

Weaknesses: R&D spend, IP creation

Engines of Innovation Driving India’s Rise

Digital Public Infrastructure (DPI) as a Global Template

From Aadhaar to UPI to CoWIN, India has architected one of the most robust digital public infrastructure stacks in the world. While advising US state governments, I’ve witnessed billion-dollar IT modernisation projects struggle to deliver what UPI achieved nationwide—frictionless, real-time, inclusive payments accessible even to rural vendors.

Countries from Singapore to Brazil are now exploring or adapting India’s DPI frameworks—a rare reversal where the innovation flows outward.

Private Sector Dynamism and Deep-Tech Transition

India’s early IT services boom was dominated by giants like TCS, Infosys, and Wipro. Today, innovation is increasingly driven by deep-tech startups in quantum cryptography (QNu Labs), private space exploration (Skyroot Aerospace), and AI-driven drug discovery (Bugworks Research). Innovation hubs such as T-Hub (Hyderabad) and IIT Madras Research Park are bridging the gap between academia and industry.

From Code to Chips

The India Semiconductor Mission seeks to position India in the global chip supply chain. With investments from Micron and Applied Materials, India is taking cautious but strategic steps into semiconductor manufacturing—a move I find well-timed given the geopolitical realignment of supply chains.

The India Semiconductor Mission seeks to position India in the global chip supply chain. With investments from Micron and Applied Materials, India is taking cautious but strategic steps into semiconductor manufacturing

Science and Technology Diplomacy

Partnerships are another engine of India’s innovation climb:

- With Japan: Nanoelectronics and advanced materials

- With the US: CHIPS Act collaborations, joint AI research

- With Israel: Agritech and defence innovationThese collaborations are not just symbolic—they are technology transfer channels.

The Bottlenecks India Must Overcome

India’s rise is promising, but three structural challenges threaten its full realisation as a technology superpower:

1. Underinvestment in R&D – At under 1% of GDP, far below the global leader average of 2–4%.

2. Talent Flight – Many top AI, quantum, and biotech graduates still move overseas for better opportunities.

3. Regulatory Instability – Frequent changes in data protection, AI governance, and FDI policies unsettle investors.

The Human Capital Advantage

With over 50% of the population under 30, India’s demographic dividend is a double-edged sword. In my years managing cross-border teams, I’ve found young Indian engineers to be eager, adaptive, and impact-driven—but their global competitiveness hinges on industry-aligned upskilling and research exposure.

India’s $245 billion IT industry is pivoting from outsourced development to AI-first solutions, blockchain integrations, and embedded systems. Recently, in my advisory work for a Fortune 500 client, we didn’t just outsource coding to India—we outsourced R&D prototyping. That’s a transformative shift

From Service Provider to Product Innovator

India’s $245 billion IT industry is pivoting from outsourced development to AI-first solutions, blockchain integrations, and embedded systems. Recently, in my advisory work for a Fortune 500 client, we didn’t just outsource coding to India—we outsourced R&D prototyping. That’s a transformative shift.

Verdict: Vision or Reality?

Yes, India is a technology powerhouse in digital infrastructure, IT services, and entrepreneurial vitality. Not yet, when it comes to original IP, fundamental research, and advanced manufacturing.

The optimism is justified, but it is conditional—dependent on R&D investment, policy stability, and global collaboration.

Conclusion: Crossing the Innovation Chasm

From the 1990s outsourcing boom to today’s DPI-led innovation, I’ve witnessed India’s technology journey from two vantage points: inside India’s boardrooms and across global corporate tables. The trajectory is real, but so are the hurdles.

If India doubles down on research funding, regulatory clarity, and talent retention, the vision of becoming a true Innovation Nation by 2047 is not just possible—it’s probable.

References

- World Intellectual Property Organization. (2024). Global Innovation Index 2024. Link

- NITI Aayog. (2024). India Innovation Report.

- OECD Science, Technology, and Industry Outlook 2024.

- Yoganandham, G. (2025). India’s Economic Trajectory 2024–2026. ResearchGate.

- Nair, S., & Selvamurthy, W. (2024). Science Diplomacy in India’s Development. NIScPR.

- Kareem, M. A. A., & Yoganandham, G. (2024). Driving Growth: IT and the Indian Economy. Academia.edu.

- Reghunadhan, R. (2025). Science and Technology Diplomacy for India. Springer.

- Voets, B., Yadav, M., & Pau, J. (2025). India’s Path Forward. Asia Business Council.

- Pullamaraju, P. (2024). Charting India’s Path in the Global Technology Landscape, KSPP.

The writer is a globally recognised AI scientist with PhD in Artificial Intelligence, Doctorate of Engineering in Cyber Analytics and Masters in Technology Management from Harvard.