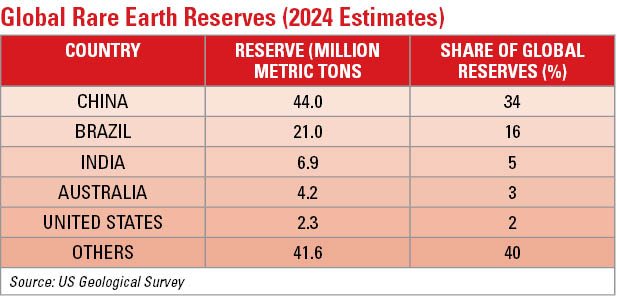

Rare earth elements are a group of 17 minerals critical to modern technology, from smartphones and electric vehicles (EVs) to defence systems and renewable energy infrastructure. China’s dominance in the global REEs supply chain—accounting for approximately 61 per cent of extraction and 92 per cent of refining—has raised concerns worldwide, particularly for nations like India that rely heavily on these materials. Recent discoveries of vast potential REEs reserves in the Himalayas, particularly in Tibet, have intensified geopolitical and economic tensions. It becomes crucial to explore the implications of China’s REEs activities in Tibet for India, focusing on strategic, economic, and environmental dimensions, while examining India’s efforts to counter this dependency.

China’s Rare Earth Dominance and the Himalayan Discovery

China has strategically positioned itself as the world’s leading supplier of REEs, leveraging decades of state investment, lax environmental regulations, and export controls. In 2023, Chinese geologists identified significant REEs deposits along a 1,000-kilometre (km) Himalayan belt in Tibet, potentially exceeding China’s existing reserves. These deposits, including minerals like neodymium, dysprosium, and lithium, are located in a geopolitically sensitive region near the Line of Actual Control (LAC), where China and India have ongoing territorial disputes. The discovery strengthens China’s grip on the global REEs market, where it already controls nearly 100 per cent of heavy REEs like dysprosium and terbium, essential for high-temperature applications in electric vehicles (EVs) and defence technologies.

The Tibetan reserves are not only economically significant but also strategically vital. China’s control over these resources could enhance its ability to influence global supply chains and exert pressure on nations dependent on REEs imports. For India, which imports 53,748 metric tons of rare earth magnets annually, primarily from China, this development amplifies vulnerabilities in its automotive, renewable energy, and defence sectors.

China’s April 2025 export controls have already disrupted Indian manufacturing, with automakers like Maruti Suzuki scaling back EV production due to magnet shortages. India imports 53,748 metric tons of rare earth magnets annually – 90 per cent from China

Strategic Implications for India

China’s REEs dominance, now bolstered by the Himalayan deposits, poses a strategic challenge for India. The proximity of these reserves to the LAC raises concerns about China’s ability to militarise resource extraction. Infrastructure development, such as roads and power supply networks required for mining, could enhance China’s strategic presence in the region, potentially escalating tensions along the disputed border. A Beijing-based researcher has warned that a “rare earth rush” could heighten geopolitical risks, particularly given the environmental and territorial sensitivities involved.

China’s history of using REEs exports as a geopolitical tool further complicates the situation. In 2010, China restricted REEs exports to Japan during a territorial dispute, and in 2025, it imposed export controls on seven REEs and magnets in response to US tariffs. These actions disrupted global supply chains, including India’s automotive industry, where manufacturers like Maruti Suzuki scaled back electric vehicle (EV) production due to magnet shortages. For India, reliance on Chinese REEs creates a strategic vulnerability, as supply disruptions could hinder critical industries and national security.

Economic Impact on India

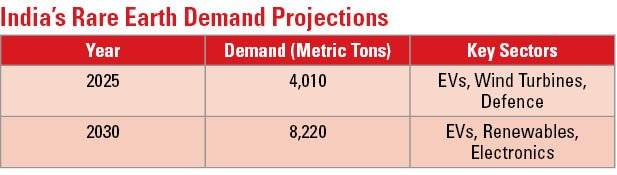

India’s economy, heavily dependent on imported REEs, faces significant risks from China’s export restrictions. In 2025, India’s demand for REEs is projected to reach 4,010 metric tons, with EVs and wind turbines accounting for over 50 per cent of consumption. By 2030, this demand is expected to double to 8,220 metric tons. The automotive sector, a key driver of India’s economic growth, is particularly vulnerable, as neodymium-based magnets are essential for EV motors. China’s export curbs, introduced in April 2025, have already caused alarm among Indian manufacturers, prompting calls for bilateral negotiations.

The economic implications extend beyond manufacturing. India’s renewable energy ambitions, including its target of 500 gigawatts (GW) of non-fossil fuel capacity by 2030, rely on REEs for wind turbines and solar panel components. Supply chain disruptions could delay these projects, undermining India’s climate goals. Moreover, the high cost of developing domestic REEs processing—due to energy-intensive and environmentally hazardous methods—poses a financial challenge. China’s cost advantage, built on decades of investment and less stringent environmental standards, makes it difficult for India to compete without significant government support.

Environmental Concerns and Regional Stability

The environmental impact of REEs mining in Tibet is a significant concern for India. REEs extraction is notoriously polluting, involving toxic chemicals like ammonium sulphate that contaminate soil and water. In China’s Baotou region, a major REEs hub, mining has led to severe environmental degradation, including cancer clusters and neurological disorders among local communities. Similar activities in Tibet could exacerbate environmental damage in the Himalayan ecosystem, which is critical for India’s water security. The region’s rivers, such as the Brahmaputra, originate in Tibet, and pollution from mining could affect downstream communities in India.

Furthermore, large-scale mining could increase China’s population and infrastructure presence in Tibet, potentially altering the region’s demographic and geopolitical dynamics. This could heighten tensions along the LAC, where India and China have clashed in recent years. Environmental degradation and territorial disputes could thus intertwine, complicating bilateral relations.

India’s Response: Building a Domestic REE Ecosystem

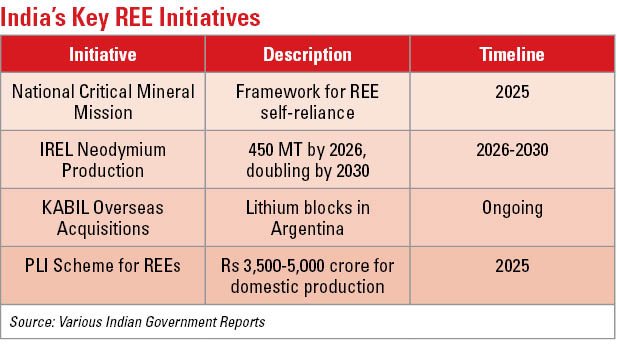

Recognising the risks of dependency, India is taking steps to develop its REEs sector. With 6.9 million metric tons of reserves—the world’s third-largest—India has significant potential. The government has launched the National Critical Mineral Mission (NCMM) in 2025 to enhance self-reliance. Indian Rare Earths Limited (IREL), a state-owned enterprise, is central to these efforts, operating extraction plants in Odisha and refining units in Kerala. IREL plans to produce 450 metric tons of neodymium by 2026, with ambitions to double output by 2030.

India is also exploring international partnerships to bolster its capabilities. The US-India Critical Minerals Partnership, part of the Minerals Security Partnership (MSP), aims to diversify supply chains through technological and financial collaboration. Australia, a major REEs producer, and Japan, which reduced its reliance on China post-2010, are also potential partners. Additionally, India’s Khanij Bidesh India Ltd (KABIL) is acquiring overseas mineral assets, such as lithium blocks in Argentina, to secure alternative supplies.

The government is incentivising private sector participation through a proposed Rs 3,500–5,000 crore scheme, including production-linked incentives (PLIs) for REEs magnet manufacturing and recycling. Amendments to the Mines and Minerals (Development and Regulation) Act (MMDR Act) are expected to streamline regulations and boost domestic production. However, challenges remain, including limited private investment, technological gaps, and environmental concerns associated with REEs processing.

The National Critical Mineral Mission aims to produce 450 metric tons of neodymium by 2026, but challenges remain. Processing REEs costs 40 per cent more in India than China, while environmental concerns plague domestic mining projects

The Road Ahead for India

India’s efforts to reduce its reliance on Chinese REEs are ambitious but face significant hurdles. Developing a domestic supply chain requires substantial investment in technology and infrastructure, which could take years to mature. Recycling REEs from electronic waste and investing in research and development (R&D) for alternative materials are promising but costly and time-intensive. Geopolitical constraints also limit the feasibility of alternative import sources, such as Kazakhstan or Australia, due to logistical and diplomatic challenges.

To counter China’s dominance, India must prioritise mining and processing capabilities while leveraging international partnerships. Collaborations with Quad nations (US, Australia, Japan) could provide technological know-how and capital. Additionally, India should invest in sustainable processing methods to mitigate environmental risks, learning from China’s costly cleanup efforts in regions like Longnan.

Takeaways

China’s discovery of REEs deposits in Tibet strengthens its global monopoly, posing strategic and economic challenges for India. The proximity of these reserves to the LAC, combined with China’s willingness to weaponise REEs exports, underscores the urgency for India to diversify its supply chains. While India’s reserves and proactive policies offer hope, overcoming technological and environmental barriers will require sustained effort. By fostering domestic production and international collaboration, India can reduce its vulnerability and emerge as a key player in the global REEs market, ensuring economic resilience and strategic autonomy.

The writer is Special Advisor for South Asia at Parley Policy Initiative, Republic of Korea. He is a regular commentator on the issues of Water Security and Transboundary River issues in South Asia. The views expressed are of the writer and do not necessarily reflect the views of Raksha Anirveda