On February 1, Finance Minister Nirmala Sitaraman delivered her eighth consecutive budget speech for the Financial Year (FY) 2025-26, which allocated Rs 6.81 lakh crore for the Ministry of Defence (MoD). This fiscal year’s defence budget is nearly 9.5% more than the previous year’s Rs 6.25 lakh crore. Besides this, the core component of the budget i.e. Capital Expenditure (CapEx), which is responsible for assets creation, infrastructural development, defence procurement and acquisition saw a meagre increase of 4.65%. Again, this raises the long-standing question: Is this CapEx allocation sufficient to address Delhi’s modern security challenges? And how does pension remain the primary consumer of the defence budget? Although, New Delhi might be cautious about current geopolitical realities, how it will counter this fiscal dilemma with limited CapEx, remains a prime concern for Delhi’s leadership.

Pension: A Key Driver of the Defence Budget

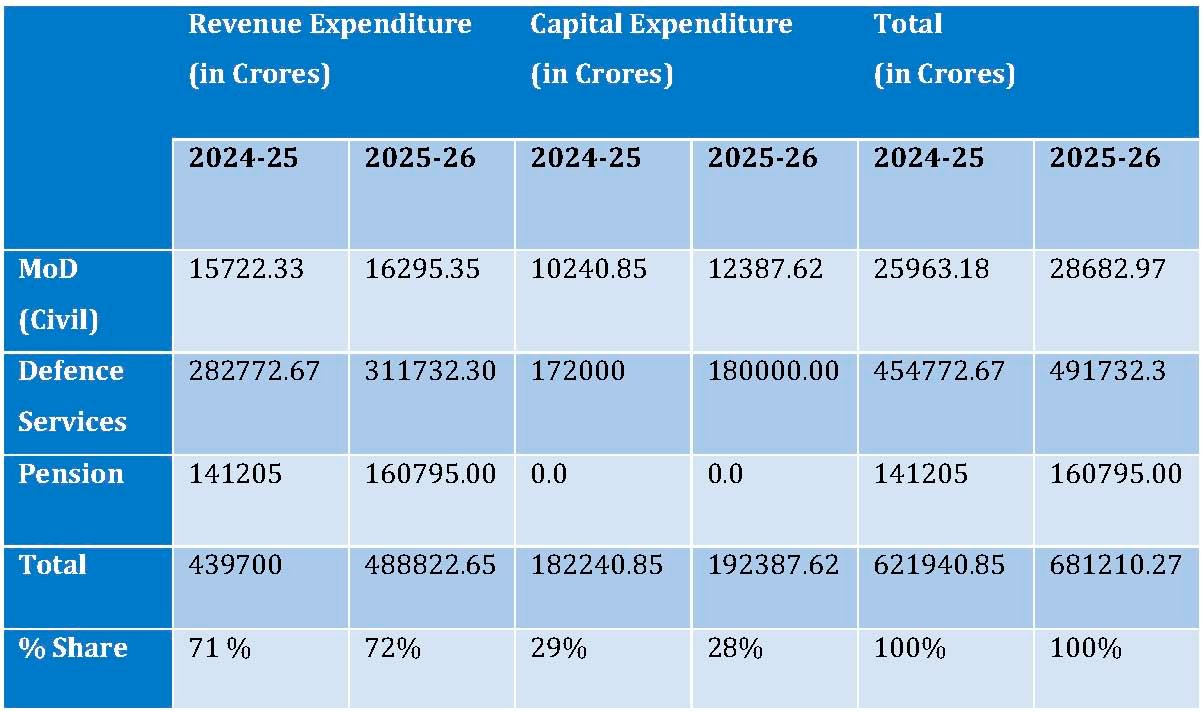

For FY 2025-26, nearly Rs 1.607 lakh crore has been explicitly given to the pensions side under the ambit of MoD, which constitutes almost 23% of the total defence budget. It is that component of revenue expenditure that has nothing to do with value addition or asset creation in the defence sector. Further, India’s defence budget remains dominated by revenue expenditure, where salary, pensions and maintenance of the Indian Armed Forces remain the primary consumers. As shown in Table 1, the current FY’s revenue expenditure constitutes almost 72% of the total defence budget, which is quite high compared to the CapEx allocation.

CapEx is meant for asset creation, infrastructural development, defence procurement and acquisition but saw a meagre increase of 4.64% in the budget. Pensions remain the primary consumer of the defence budget. This fiscal dilemma is a prime concern

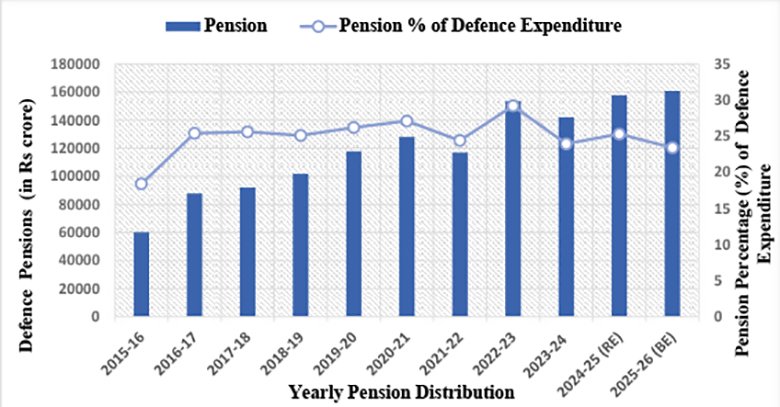

India has one of the highest numbers of troops in the armed forces, which are essentially consuming a major proportion of the defence budget through pay and allowances, pensions, and maintenance. This triggered Delhi to spend more on manpower-related expenditure, where pensions remain the vital element. Here, Figure 1 depicts the pension value in both real terms and percentage terms. Hence from Figure 1, it is quite evident that pension value as a percentage of the total budget has remained constant. However, in real terms, there has been a substantial increase in pension value in recent years. The specific rise in defence pensions has been witnessed after the implementation of the One Rank One Pension Scheme (OROP) in 2015.

Figure 1: Expenditure on defence pensions (2015-16 to 2025-26) (in Rs crore)

Low CapEx and Fiscal Dilemma in Defence Budget

Capital investment has multifaced implications for the country’s economic growth, which stimulates the virtuous cycle of economic growth by spurring demands and supply in the domestic market. Similarly, more investment in the defence sector through capital outlay can inevitably accelerate India’s Indigenous defence production pathway by incorporating state-of-the-art technologies to fulfil its ambition of ‘Aatmanirbhar Bharat’ in the defence sector. However, this FY’s CapEx has seen a meagre increase, particularly concerning Delhi’s geopolitical contestation with Beijing and Islamabad. Table 1, highlights that nearly 28% of the total defence budget has been allocated for capital expenditure, which is quite low considering the modern-day security dilemma. Moreover, this allocation is also quite low as compared to the standing committee on defence’s recommendations regarding the ideal equilibrium between revenue expenditure and capital expenditure should be 60:40. Therefore, this imbalance has given rise to a new fiscal dilemma vis-à-vis Delhi’s fiscal management and defence budget consolidation, particularly concerning low CapEx and high pension.

Table 1. Shares of Revenue and Capital in MoD Budget (2024-25 and 2025-26)

Question of High Manpower Cost

Excess expenditure on revenue has a reverse effect on CapEx. More expenditure on manpower will essentially consume that value which otherwise could be utilised for capital outlay to incorporate modern-advanced technologies and weapons for the Indian Armed Forces. Additionally, the modernisation process and research and innovation have a direct correlation with CapEx, more investment in this sector will surely enhance the preparedness of Indian troops for futuristic war. Moreover, it is also true that the feasibility of full-fledged war has become quite low and now the focus is to win short wars through tactical means. Therefore, given the current dynamics of modern warfare, capacity building through the incorporation of cutting-edge technologies should be the prime motive of New Delhi.

Nearly Rs 1.607 lakh crore has been allocated for pensions, almost 23% of the total defence budget. India’s defence budget remains dominated by revenue expenditure, where salary, pensions and maintenance remain the primary consumers

To reduce excess manpower-related costs, New Delhi has also implemented the Agnipath scheme, which provides an opportunity for patriotic and motivated youth to serve the nation for a limited time (without paying them any extra perks like pensions and other allowances). Nonetheless, this scheme has come up with strong financial motivation. However, besides this addressing excess manpower-related cost in India’s defence budget allocation requires more multifaceted approaches to address various nuances of India’s defence budget. It requires optimal utilisation of existing expenditure through reallocation of resources effectively and efficiently. In this context, one key chapter that New Delhi can learn from China’s People’s Liberation Army (PLA) is, how they are focusing towards transforming their forces from ‘Quantitative’ to ‘Qualitative’ forces by optimising the budget ratio between various heads. In this domain, the PLA focused on rebalancing its resources by diversifying excess Army costs to the Navy, Rocket Force and Strategic Support Force. That allows it to focus on the maritime and cyber domains. Further, the reduction of non-combat and non-essential personnel helps China to improve its fiscal management. Therefore, a similar approach can also benefit India vis-a-vis its long-term vision of containing manpower costs.

Considering the complexities of modern-day warfare, adequate investment in CapEx is imperative. The valour of manpower cannot be compromised. Therefore, a balance between CapEx and pension is required to address futuristic warfare

Conclusion

Inevitably, considering the complexities and doctrine of modern-day warfare, adequate investment in CapEx is categorically imperative for New Delhi. Also, the valour of manpower cannot be compromised in the armed forces. Therefore, an adequate balance between CapEx and pension is required to address futuristic warfare. Further, an assessment of the current defence allocation (1.9 % of GDP) also needs to be re-examined to sustain India’s national security. Therefore, the immediate focus needs to be primarily on re-assessing pensions, relocation of financial resources, and optimum utilisation of advanced automation technologies through increased investment in R&D.

The writer is a Ph.D research scholar at Department of National Security Studies, Central University of Jammu. The views expressed are personal and do not necessarily carry the views of Raksha Anirveda