In today’s world, the geopolitical imperatives play a crucial role in both the bilateral and multilateral relationship between nations. Additionally, the actions and reactions affect the global comity not just your friends and foes separately. An apt illustration in this regard is the current crisis faced by many countries across the world, in view of China curtailing its rare earth minerals export to other countries, in response to the tariffs imposed by the Americans on Chinese goods.

The impact of this ban has been felt by America and a host of other countries, including India, too. Historically, the progress of mankind has been linked intrinsically to the use of metals, and in the present age rare earth metals or minerals hold the key to human development.

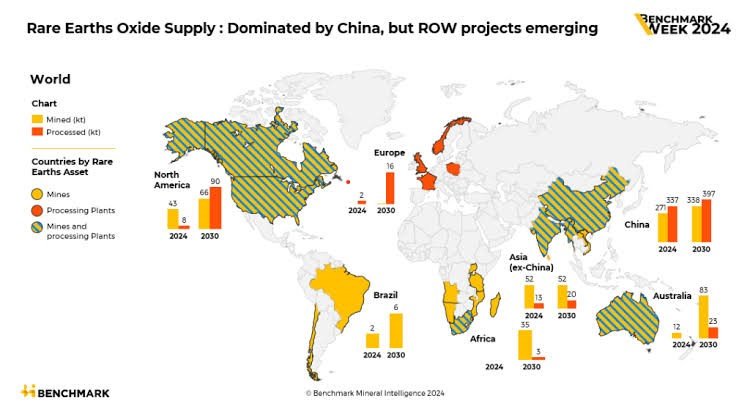

Rare earth minerals are indispensable for producing permanent magnets, which are used in high-demand items such as smartphones, computers, electric vehicles, lasers, and missile guidance systems. China alone accounts for two-thirds of global rare earths mining. Australia, Chile, and China account for most of the lithium mining.

In the past, China has used its rare earth minerals dominance as a trade tool, tightening export controls on key minerals like gallium, germanium, and graphite, citing national security concerns — moves widely seen as retaliation to western curbs on China’s access to advanced chip technologies.

Rare earth magnets, such as neodymium-iron-boron magnets, are essential for high-performance motors used in electric vehicles and renewable energy technologies. India has some reserves of rare earth minerals but lacks large-scale processing and magnet-making capabilities, keeping it dependent on imports from China and a handful of other suppliers.

As countries like India explore their manufacturing prowess and ramp up their production capacities in critical minerals dependent sectors, geopolitical tensions have created turbulence and China has retaliated with export cuts of critical minerals, of which it is a dominant player. China currently dominates around 60-70% of global rare earth production and over 85% of processing capacity.

Realistically, when it comes to critical minerals, India cannot rely on China — it needs to fast track its own exploration. It is near-impossible to secure mineral supply chains from overseas — even the US is struggling, in this regard. As a country that is geologically rich, India must explore within.

At present, China dominates the global REE market, accounting for 90% of production and processing. However, surveys carried out by the Geological Survey of India (GSI) and the Atomic Minerals Directorate (AMD) in Rajasthan have uncovered large deposits of rare earth minerals in the region. These findings could help India become self-reliant and play a key role in the global supply chain.

In today’s world, the geopolitical imperatives play a crucial role in both the bilateral and multilateral relationship between nations. Additionally, the actions and reactions affect the global comity not just your friends and foes separately. An apt illustration in this regard is the current crisis faced by many countries across the world, in view of China curtailing its rare earth minerals export to other countries, in response to the tariffs imposed by the Americans on Chinese goods

However, despite possessing the world’s third-largest REE reserves (6.9 million tonnes), India contributes less than 1% of the global production; just 2,900 tonnes per year. This is largely due to outdated processing technologies, a shortage of technical expertise, and underdeveloped mining infrastructure.

To change this scenario, in January 2025, the Centre also launched the National Critical Mineral Mission (NCMM) to establish a robust framework for self-reliance in the critical mineral sector. Under this mission, GSI has been assigned 1,200 exploration projects between 2024–25 and 2030 – 31, with the latest find in Bhati-Khera, Rajasthan considered a strategic cornerstone.

To complement the mission, the government has introduced a Rs 1,000 crore Production-Linked Incentive (PLI) scheme for boosting the domestic manufacture of rare earth magnets. With policy support and recent discoveries, India now has a real opportunity to reduce reliance on China and become a global player in this strategic sector.

On the other hand, MOIL Ltd, India’s largest manganese ore producer, is aggressively pursuing global mining deals to secure vital raw material supplies.

MOIL is in early negotiations for international assets including copper and nickel from Finland’s Zawar Group, and vanadium from Australia’s Australian Vanadium Ltd and South Africa’s Vanadium Resource Ltd. It has also approached Indonesia’s Merdeka Battery Materials for potential tie-ups, aiming to diversify into critical battery minerals.

Earlier in July, the Ministry of Heavy Industries proposed a Rs 1,345-crore scheme to boost domestic production of rare earth magnets. India has some reserves of rare earth minerals but lacks large-scale processing and magnet-making capabilities, keeping it dependent on imports from China and a handful of other suppliers.

Meanwhile, the state-run Khanij Bidesh India Ltd, or KABIL, is working to secure critical mineral supplies through global partnerships. It has started lithium exploration in Argentina’s Fiambalá region and has agreements with companies in the UAE, ONGC Videsh and Oil India for international mining opportunities. It has also partnered with the Council of Scientific and Industrial Research-Institute of Minerals and Materials Technology for technical cooperation in processing and extraction.

India’s state-run miner, Indian Rare Earths Limited (IREL), is working on reducing exports to prioritise domestic supply and exploring resources in Oman and Vietnam. India is also partnering with Australia, which has substantial rare earth deposits, to secure supplies and technology.

As countries like India explore their manufacturing prowess and ramp up their production capacities in critical minerals dependent sectors, geopolitical tensions have created turbulence and China has retaliated with export cuts of critical minerals, of which it is a dominant player. China currently dominates around 60-70% of global rare earth production and over 85% of processing capacity

By incentivising domestic production, the government aims to secure critical supply chains for its clean energy, e-mobility, and other manufacturing ambitions, and reduce the strategic risks posed by sudden supply disruptions or price shocks triggered by export restrictions.

The scheme is part of a broader push under the self-reliant India initiative to localise production of key components in high-tech industries and create a safe harbour to keep the manufacturing machinery running in India at a time when there is a supply-chain disruption due to China’s machinations.

The move comes as major economies, including India, look to reduce reliance on China and find ways to revive supply chains with indigenous capacity of critical minerals and rare earth elements, controlling around 60–70% of global rare earth production and over 85% of processing capacity.

In this regard, on July 1, the Quad Foreign Ministers also released a joint statement announcing the Quad Critical Minerals Initiative, an ambitious expansion of the partnership to strengthen economic security and collective resilience by collaborating to secure and diversify critical minerals supply chains.

To break its dependency on China, India is forging new diplomatic and resource partnerships with countries like Brazil and Ghana. In fact, Brazil has emerged as a key player in this regard.

Known for its Amazon rainforests and mineral wealth, Brazil is now becoming a major producer of rare earth minerals. With an estimated reserve of over 21 million tonnes, Brazil holds the second-largest deposits in the world, just behind China.

In 2024, Brazil launched the Serra Verde mine, the world’s only large-scale, mixed rare earths production unit outside China. To reduce China’s dominance and respond to global demand, Brazil has created a $800 million strategic fund and begun partnering with trusted nations like India.

At the 2025 BRICS Summit in Rio de Janeiro, India and Brazil quietly signed an agreement to collaborate on rare earth mineral cooperation. Prime Minister Narendra Modi emphasised the need for “secure, resilient, and diversified supply chains,” setting a strategic direction for bilateral collaboration in critical minerals.

However, despite possessing the world’s third-largest REE reserves (6.9 million tonnes), India contributes less than 1% of the global production; just 2,900 tonnes per year. This is largely due to outdated processing technologies, a shortage of technical expertise, and underdeveloped mining infrastructure

Among the global partnerships India has established is the one with the US – a ‘strategic mineral recovery’ initiative. It aims to recover and process critical minerals and rare earths from heavy industries like aluminium, coal mining, and oil and gas. If successful, it will accelerate research and development, and investment across the entire critical mineral value chain. India and the US are also members of a Mineral Security Partnership, or MSP.

India has already launched a ₹34,000 crore National Rare Earth Mission, and is promoting domestic processing technologies. Still, global cooperation will be the key to success.

In reality, India’s track record on sourcing rare earths within its boundaries has been patchy. Lithium reserves were found in Jammu and Kashmir and were estimated at 5.9 million tons. It seemed that India had struck gold and would be free of reliance on China.

But a year later, it seems that it may not be profitable to extract the lithium and perhaps only a fraction of it might be usable. Also, the surroundings are environmentally sensitive.

Among the challenges before India, in the area of critical minerals industry are:

India lacks proven reserves for minerals such as cobalt, niobium, germanium and rhenium. Nearly half of the 49 critical mineral blocks up for auction remain unclaimed. At many places technical limitations make extraction difficult. Further, land acquisition, resettlement and long project timelines are obstacles. Coupled with this is the absence of commercial-scale processing technology.

India’s rare earth minerals are primarily found in monazite-rich coastal sands of Andhra Pradesh, Odisha, Tamil Nadu, Kerala, and West Bengal. India may soon strike it rich as new findings in Rajasthan could unlock rare earth elements, helping the nation rival China in global mineral dominance

With the third-largest rare earth reserves in the world, estimated at 6.9 million tonnes, India has the potential to reduce its dependency on Chinese imports. However, to truly leverage it, India must ramp up domestic extraction, build refining capacity, and invest in the entire value chain, from mining to magnet-making, which remains underdeveloped, say experts.

By incentivising domestic production, the government aims to secure critical supply chains for its clean energy, e-mobility, and other manufacturing ambitions, and reduce the strategic risks posed by sudden supply disruptions or price shocks triggered by export restrictions. The scheme is part of a broader push under the self-reliant India initiative to localise production of key components in high-tech industries and create a safe harbour to keep the manufacturing machinery running in India at a time when there is a supply-chain disruption due to China’s machinations

They suggest that while India’s potential is significant, technological, and regulatory hurdles must be overcome to capitalise on this crisis. Furthermore, India’s rare earth deposits are low in concentration, making them harder to extract economically. They are also often mixed with radioactive elements like thorium, which adds safety risks and raises extraction costs.

With the third-largest reserves, India, despite its own limitations and a delayed start, has a rare chance to reduce reliance on China. But this opportunity will be real only if New Delhi builds a robust supply chain, ensures sustained investment, and undertakes key policy reforms to turn the crisis into a strategic advantage. India can turn China’s rare earth stranglehold into a rare opportunity. But it will have to show a rare resolve.

Securing the future necessitates securing the technologies needed to create it. That will mean not just strong global partnerships but also tackling the significant obstacles to their extraction at home.

-The writer is a New Delhi-based senior commentator on international and strategic affairs, environmental issues, an interfaith practitioner, and a media consultant. The views expressed are personal and do not necessarily carry the views of Raksha Anirveda