New Delhi. The Capgemini Research Institute’s latest report, ‘The strategic edge: How digital continuity drives business outcomes in aerospace and defense,’ published on June 24, finds that digital continuity – the seamless integration of data and information across all stages of the product lifecycle and linked to the external partner ecosystem – is emerging as a critical enabler of business transformation in the aerospace and defence (A&D) sector. Over 80% of A&D leaders surveyed view digital continuity as a driver of business transformation and a route to gaining a competitive advantage.

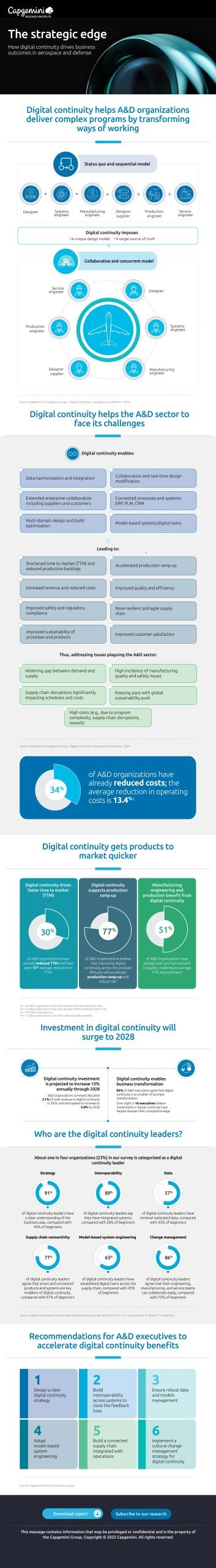

In 2024, A&D organisations on average allocated a significant 2.1% of their annual revenue to these initiatives, to ramp up production, accelerate development cycles, reduce operational costs, and stay agile amid global pressures. In the context of rising costs, supply chain instability, and geopolitical movement, investments in digital continuity are expected to increase to 3.4% by 2028.

“Digital continuity is a critical imperative for aerospace and defence organisations to thrive in today’s challenging and uncertain geopolitical environment. If it is embraced as a way of working, it will help organisations increase productivity and free up key resources from the waste created by disconnected systems and data. Ultimately, it enables operational excellence, reduces product development cycle times and fosters a collaborative culture, setting A&D players up for long-term success. Business leaders clearly recognise this and as a result have been ramping up their investments in these initiatives,” said Lee Annecchino, Global Industry Lead, Aerospace and Defense at Capgemini. “In order to leverage the full potential, A&D organisations must focus on building interoperability across systems, enabling robust data management and adopting a comprehensive change management strategy.”

Digital continuity helps A&D organisations to ramp up quickly, driving many business benefits

Nearly nine in 10 (86%) A&D executives agree that digital continuity is important to their organisations’ ramping-up strategies, and 77% believe that improving digital continuity will accelerate the process. Around a third (34%) of A&D organisations have already reduced costs with 13% cost reduction on average because of digital continuity. Thirty percent of A&D organisations have already realized shortened time to market and 18% have accelerated product development cycle times because of digital continuity, making it a top priority for investment.

Nearly nine in 10 (86%) A&D executives agree that digital continuity is important to their organisations’ ramping-up strategies, and 77% believe that improving digital continuity will accelerate the process. Around a third (34%) of A&D organisations have already reduced costs with 13% cost reduction on average because of digital continuity. Thirty percent of A&D organisations have already realized shortened time to market and 18% have accelerated product development cycle times because of digital continuity, making it a top priority for investment.

Defense organisations are better prepared to ramp up production

According to the survey, 44% of defence organisations are prepared to ramp up production compared to just over a third of civil aerospace organisations. The readiness of defence organisations to ramp up production can be driven by geopolitical uncertainty and technological and infrastructure investment, including a more flexible manufacturing execution system (MES), and a more resilient supply chain. For example, 65% of defence organisations agree that their supply chain is adaptable to quickly changing customer demands, while only 45% of civil aerospace organisations believe the same.

The report also finds that more than 8 out of 10 (86%) defence organisations recognise the need to integrate AI and generative AI in engineering and product development and over half (56%) to develop autonomous systems. However, less than half of the defence organisations are prepared to integrate AI (44%) and only 35% are prepared to develop autonomous systems.

In order to thrive, A&D organisations must continually evolve in terms of skills, processes, technologies, security methods, and compliance policies concludes the report.

Report Methodology

In March 2025, the Capgemini Research Institute conducted a global survey to assess the maturity of digital continuity in aerospace and defence (A&D) organisations and the benefits achieved. The survey included 179 A&D organisations across 16 countries in Asia-Pacific, Europe, the Americas, and the Middle East. Over half (51%) of the participating organisations are headquartered in the United States. The survey sample also included 28 public sector or government organisations. All surveyed organisations have annual revenues exceeding $500 million, with the majority (56%) reporting revenues greater than $1 billion.