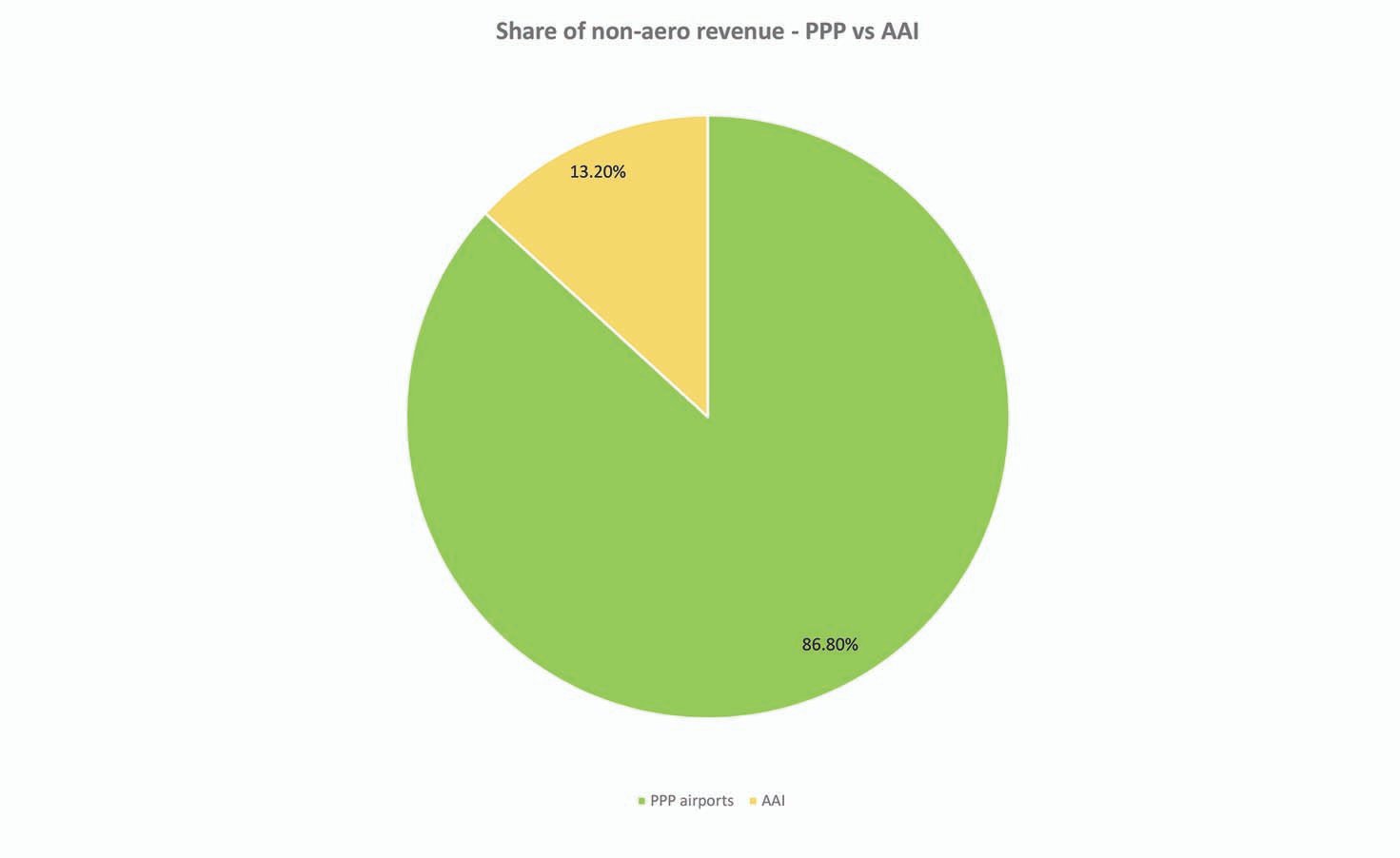

Mumbai: In its latest report- Beyond the Runway- Scope of Non-Aero Revenue and Aerocities in India, Knight Frank India, a leading real estate consultancy in the country, in association of National Real Estate Development Council (NAREDCO), highlighted the growing importance of non-aero revenues in shaping the future of India’s airports and urban growth. The analysis shows that airports managed under the public-private partnership (PPP) model generate 87% of the country’s total non-aero revenue while handling 64% of total traffic. This reflects the operational efficiency of the PPP model and its critical role in diversifying airport income streams beyond traditional aeronautical revenues.

The ability of PPP airports to outperform their government-operated counterparts underscores the need for robust commercial strategies. Non-aero revenue streams, including retail, food and beverage, duty-free, parking, advertising, and real estate leasing, are increasingly central to financial sustainability. With traffic set to multiply in the coming years, this diversification will become indispensable for airport operators.

Shishir Baijal, Chairman and Managing Director, Knight Frank India, said, “India’s airports are at an inflection point. The strong performance of PPP airports in driving non-aero revenues highlights how critical these streams are for long-term sustainability. With traffic set to rise to nearly ~600 million by 2030, airports must think beyond runways and embrace integrated commercial ecosystems such as aerocities. This will not only strengthen airport profitability but also create new engines of urban growth.”

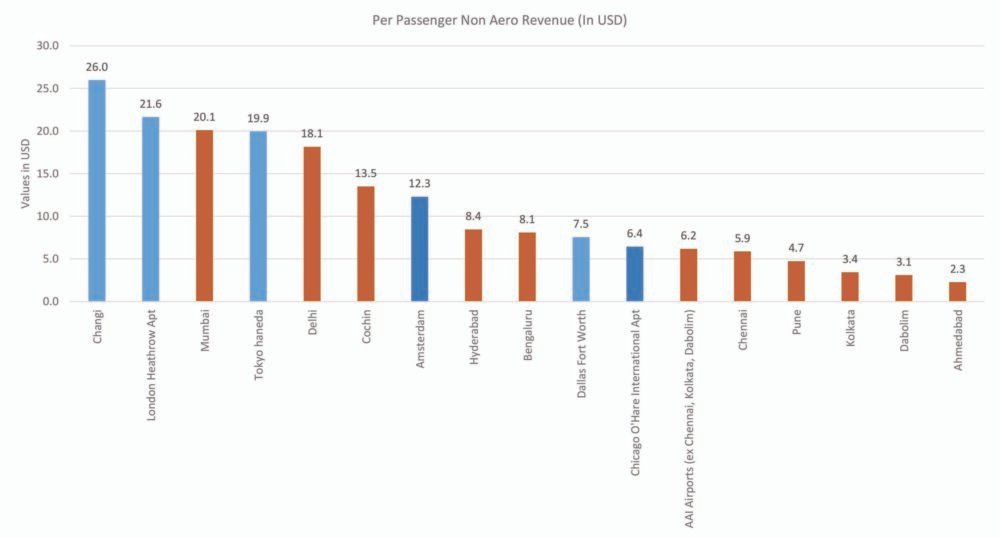

Global Benchmarks: Mumbai and Delhi at Par with Heathrow and Haneda

The report notes that India’s largest hubs Mumbai and Delhi airports generate per capita non-aero revenues of USD 20.1 and USD 18.1 respectively, nearly matching leading global benchmarks such as London Heathrow at USD 21.6 and Tokyo Haneda at USD 19.9.

These figures highlight that Indian airports are capable of achieving world-class commercial performance, particularly in metros where international traffic and passenger spending power are higher. For global investors, this convergence demonstrates the maturity and attractiveness of India’s top-tier airports as growth hubs.

Air Passenger Traffic Outlook

As per the report, India’s annual air passenger traffic is projected to grow to ~600 million by FY 2030, up from 412 millionn in 2025. This sharp growth trajectory presents both opportunities and challenges for airport operators. While capacity expansion remains vital, monetising this rising passenger base through non-aero revenue channels will be equally critical to financial sustainability.

Propelled by a confluence of structural and policy drivers, rising disposable incomes, a rapidly expanding middle class, deeper regional connectivity and significant capacity augmentation across both metro and non-metro airports. The industry’s evolution is further supported by private sector participation, modernisation of airport infrastructure, and increasing integration with global air travel networks. The analysis underlines that non-aero revenue will no longer be a secondary income source but a central growth lever for the aviation sector.

Aerocities: Unlocking Growth Beyond Airports

The report identifies aerocity development as a game-changing opportunity to generate non-aero revenue while catalysing broader economic growth. Aerocities large-scale urban ecosystems planned around airports can integrate office spaces, hospitality, retail, entertainment, logistics, and convention centres.

Such developments allow airports to transform from transit points into vibrant economic hubs, supporting job creation, tourism, and global connectivity. For airlines and operators, aerocities mean steady non-aero income, while for governments they become engines of urban development. By integrating real estate development with aviation, India’s airports can position themselves as growth accelerators in the global economy.

Unlocking Revenue Potential

With Indian air passenger traffic projected to increase by nearly 50% from 412 million in FY 2025 to 600 million by FY 2030, non-aeronautical revenue is poised to see an exponential rise—benefiting from both increased passenger numbers and improved per-passenger spending. Even a modest increase of USD 1 (INR 87) per passenger across the projected traffic base could translate into an USD 29.5 bn in annual non-aero revenues for Indian airports in 2030. A 26% from the existing value. This creates a strong incentive for operators to invest in premium retail zones, food courts, entertainment facilities, and destination experiences that attract both travellers and non-travelling visitors.

This projection demonstrates the vast potential of scaling non-aero strategies from expanding retail footprints to leveraging technology-driven passenger experiences and optimising aerocity planning.

Dr Rajeev Vijay, Executive Director – Government and Infrastructure Advisory, Knight Frank India, said, “The fact that Mumbai and Delhi airports are already generating per passenger non-aero revenues at par with Heathrow and Haneda demonstrates the potential of India’s aviation sector. With private equity and institutional investors eyeing growth opportunities, the next phase will be defined by aerocity-led development. These urban ecosystems can transform airports into economic powerhouses, while unlocking new revenue streams that are less vulnerable to cyclical passenger traffic.”

G Hari Babu, President, NAREDCO, said, “At the 17th NAREDCO National Convention, the discussions on airports and aerocities reaffirm what the Knight Frank report brings out so strongly — that the future of aviation growth in India is deeply linked with real estate and infrastructure development. With passenger traffic projected to touch 600 million by 2030, airports are no longer just transit hubs, they are becoming integrated economic zones. The development of aerocities around major airports can unlock massive non-aero revenues, create new business districts, and stimulate allied infrastructure such as hotels, retail, and commercial spaces. This is an opportunity for the real estate sector to partner in building world-class urban ecosystems that will drive India’s next phase of growth.”

The findings of Beyond the Runway: Scope for Non-Aero Revenue and Aerocities in India, make it clear that India’s aviation sector is entering a transformative phase. With PPP airports already leading non-aero revenue generation, passenger growth on the rise, and aerocity development on the horizon, the future of India’s airports lies in embracing a holistic growth model that combines aviation, commerce, and urban development.